Public CPG Stock Performance in 2024: Is DTC Back?

After a difficult few years for consumer product companies – and DTC brands in particular – 2024 was seen as the year that fortunes would hopefully begin to turn around. How did the consumer goods sector perform as a whole? Which categories showed the best returns? In 2023 it was a consumer brand, Abercrombie & Fitch, that was responsible for the single greatest performance of the entire S&P 500 (286% growth), even besting NVIDIA in the “year of AI”. Did another CPG brand take up the mantle in 2024?

Hahnbeck’s dataset covering all of the CPG companies on the North American public markets reveals some interesting findings, including some positive news for DTC brands.

Tapestry, whose brands include Kate Spade and Coach, was the best-performing CPG stock on the S&P 500 in 2024.

Publicly-Traded Consumer Product Companies in 2024

Hahnbeck’s cohort of publicly-traded consumer goods companies includes 474 firms listed on the North American public markets. Our dataset is not based merely on broad “consumer staples” and “consumer discretionary” categorisations, but instead includes only those firms that are truly relevant* to an analysis of the consumer products sector. Of these, 433 companies traded through the entire year in 2024. Using the measurement period of 31 Dec 2023 to 31 Dec 2024, the market capitalisation (market cap) for the consumer product sector was up 19%, slightly below the 23% achieved by the S&P 500.

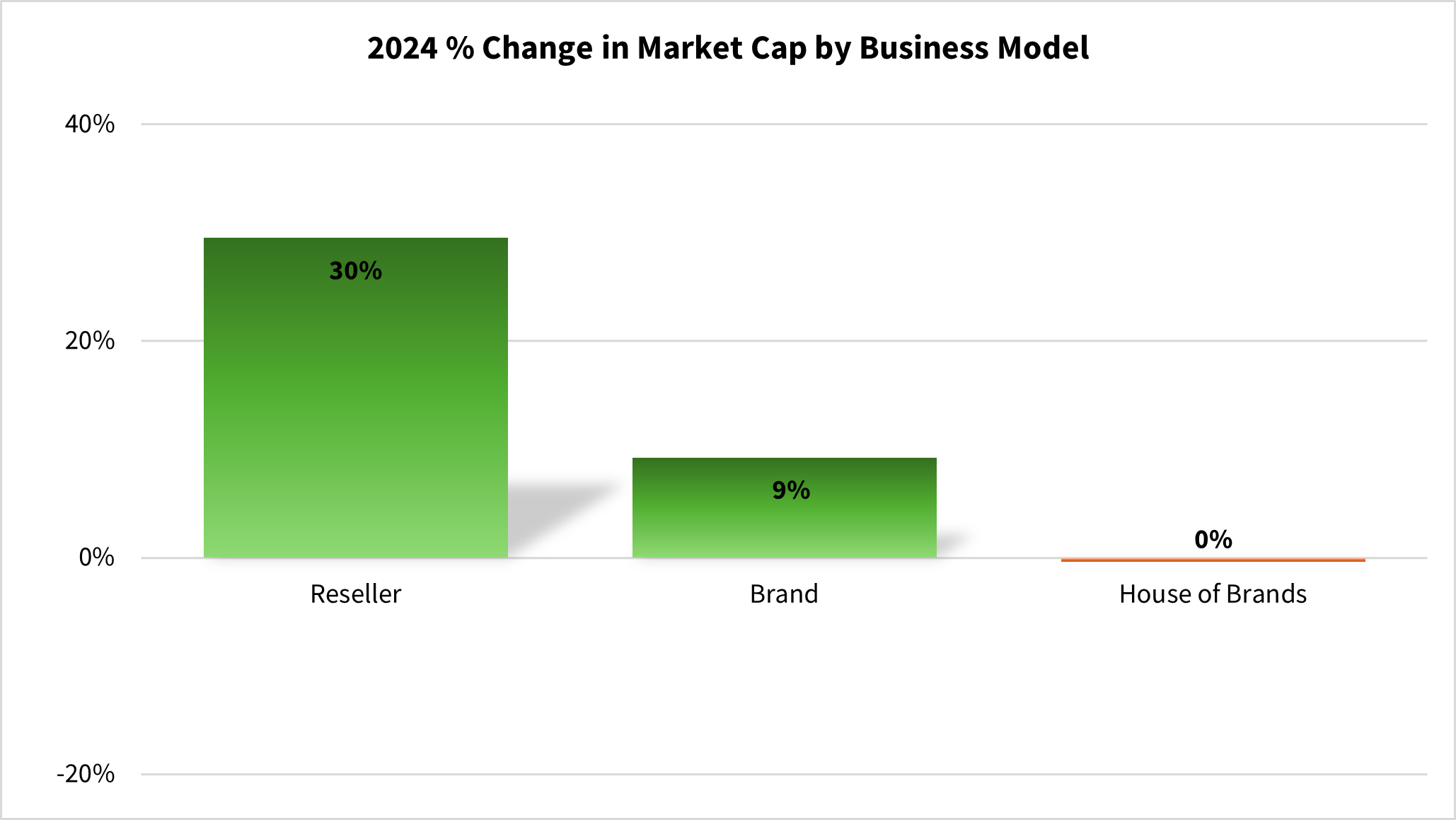

With this universe of CPG companies, the Reseller category is the largest based on total market cap and is the category with the most constituents, at 108 companies represented. This category, which includes firms such as Walmart, Costco and Home Depot, performed very well in during the measurement period with total market cap rising by 30% which was instrumental in lifting the average across the overall CPG sector.

Individual company data: Koyfin

Performance by Category

Dissecting the consumer goods sector further, we can also analyse the relative performance by the primary category each company operates in. Of the 13 categories we defined within the CPG universe, only five ended the year with a positive change in market cap. The strongest performer was Pet Supplies, which saw an increase of 51%, followed by Consumer Electronics at +44%, Home & Kitchen at +15%, Health & Wellness at +9%, and Other at 7%.

Individual company data: Koyfin. Note: The “All CPG” category includes the impact of Resellers, who are not shown in the graph.

Other categories such as Leisure / Recreational and the Food & Beverage categories saw small declines in performance, while the Sports & Outdoors, Beauty, and Outdoor & Garden categories saw the biggest declines.

It is important to be cautious about over-interpreting this data, especially for categories which have a small number of constituents. For example, the Sports & Outdoors, Pet Supplies, and Baby & Toddler categories have 10 or fewer companies each. This means that that a large swing in a single company can have a material impact on the overall average for the category.

However, it’s fair to say that the Beauty category performed exceptionally poorly in 2024. Almost every consumer goods company traded on the north American markets and classified as “beauty” performed negatively in 2024. The largest, Estee Lauder (NYSE: EL), declined by 49%. Beauty industry analysts referred to the ongoing impact of China’s economic slowdown as well as a reduction in discretionary spending in beauty in both the US and Europe. This made Beauty the worst performing consumer goods category in 2024, with a 38% decline in overall market cap.

Individual company data: Koyfin

Interestingly, M&A activity in the beauty sector remains relatively strong compared to other categories, as investors remain convinced of the potential of up and coming brands. The rate of acquisitions in the Beauty sector, by both private and public companies, was relatively strong in 2024. In GW Hahnbeck’s recent survey of consumer private equity firms, Beauty was also one of the categories listed most often by investors as a category into which they intend to deploy capital over the following 12 months.

On the other hand, the top performer in 2024 was the Pet Supplies category, with a 51% increase in overall market cap. This was primarily driven by the largest company in the cohort, Freshpet (NASDAQ: FRPT), whose market cap rose by 72% last year. Smaller constituents such as Dogness International Corp (NASDAQ: DOGZ) and BARK (NYSE: BARK) also delivered outstanding growth, with their respective market caps increasing by 971% and 122%.

DTC Brands in 2024

Lasering in on DTC brands (where the company’s own website is the predominant sales channel), 33 companies traded through the entire year in 2024. The market cap of the DTC cohort rose by a stunning 30%, significantly outperforming both the S&P 500 and the CPG sector as a whole.

However, fortunes in the group were mixed, with nearly two-thirds of the companies in the cohort seeing a drop in market cap. The strong overall performance was led by the stellar performance of a handful of companies, such as Hims & Hers Health Inc. (NYSE: HIMS) up 179%, Warby Parker Inc. (NYSE:WRBY) up 75%, and Peloton Interactive Inc. (Nasdaq: PTON) up 51%.

“The market cap of the DTC cohort rose by a stunning 30%, significantly outperforming the S&P 500”

While the market cap of the DTC brand cohort increased, its valuation (relative to earnings) decreased. The average trailing P/E multiple went from 48.8x to 43.6x, an 11% decline. So while earnings increased, the market did not reward these companies with a corresponding increase in valuation. DTC brands currently have to make more profit per $1 valuation than they did at the start of 2024 (and far more than in 2021).

Meanwhile, the broader CPG cohort has seen an even bigger decrease in average trailing P/E multiple, which fell by 16%, from 41.2x to 34.7x by the end of 2024.

In contrast, the average trailing P/E multiple for the S&P 500 index increased by 17%, going from 25.1x to 29.4x by the end of the year.

In short, CPG and DTC companies had a good year, with earnings increasing. However, with valuation multiples decreasing, the absolute value of these companies still rose, but at a slower rate than their earnings.

Top Performers

Ralph Lauren (NYSE: RL)

Did 2024 see another consumer goods company leading the entire S&P 500, repeating Abercrombie & Fitch’s performance from 2023? Unfortunately not, although there were a number of stand-out performers.

Note: as one might expect, small and micro-cap stocks, such as companies trading on the NasdaqCM, NYSEAM, TSXV, CNSX, and pink sheets, naturally show the largest fluctuations (both up and down). In this analysis, we will focus on the performance of larger stocks.

Of the 53 CPG companies included in the S&P 500, it was apparel and footwear brands again dominating the ranks with Tapestry Inc. (NYSE: TPR), Deckers (NYSE: DECK) and Ralph Lauren (NYSE: RL) at positions 1, 2 and 5 on the list. Tapestry wasn’t close to being the best overall performer on the S&P 500 like Abercrombie the year before, but its 80% growth was still outstanding, as was Deckers’ 79%. Food companies such as Kroger (NYSE: KR) and Kellanova (NYSE: K) performed very well (the latter buoyed by the Mars acquisition news), as did resellers and platforms such as Costco (Nasdaq: COST), Amazon (Nasdaq: AMZN) and eBay (Nasdaq: EBAY). Electronics manufacturer Garmin (NYSE: GRMN) also saw its value bounce back by 61% in 2024 after a difficult few years, with stronger profits driving its stock price to all-time highs.

Top Performing CPG Stocks in the S&P 500

1. Tapestry Inc. (NYSE: TPR), +80%

2. Deckers Outdoor Corporation (NYSE: DECK), +79%

3. Walmart Inc. (NYSE: WMT), +71%

4. Garmin Ltd. (NYSE: GRMN), +61%

5. Ralph Lauren Corporation (NYSE: RL), +54%

6. Amazon.com Inc. (Nasdaq: AMZN), +47%

7. Kellanova (NYSE: K), +46%

8. Costco Wholesale Corporation (Nasdaq: COST), +39%

9. The Kroger Co. (NYSE: KR), +35%

10. eBay Inc. (Nasdaq: EBAY), +31%

Top Performing Smaller NYSE CPG Stocks

If we look beyond the top 500 publicly traded companies trading on US exchanges, we spot a number of well-known brands which have seen strong performance in 2024. For example, if we look at CPG brands trading on the NYSE that are not part of the S&P 500, the 3 top performers are:

1. Barnes & Noble Education Inc. (NYSE: BNED), +283%

2. Hims & Hers Health Inc. (NYSE: HIMS), +179%

3. GameStop Corp. (NYSE: GME), +162%

Top Performing Small-Cap CPG Stocks

Given the greater volatility associated with small-cap stocks, one would naturally expect to see higher growth (and declines) if we look at the smaller end of the CPG universe. In fact, a couple of names experienced a nearly 10 fold increase in market cap during the year. Since these are smaller companies, the top performers may sound less familiar than companies that are part of the S&P 500 index. In fact, if we were to consider the entire CPG universe of 433 companies that traded throughout 2024, the best performing S&P 500 constituent, Tapestry, would rank at only 46th place.

The top performing small-to-medium cap CPG companies are:

1. Dogness International Corporation (Nasdaq: DOGZ), +971%

2. Fitell Corporation (Nasdaq: FTEL), +934%

3. Laird Superfood Inc. (NYSEAM: LSF), +853%

Top Performing DTC Brands

Zeroing in on the performance of DTC brands, the top performers were:

1. Hims & Hers Health Inc. (NYSE: HIMS), +179%

2. a.k.a. Brands Holding Corp. (NYSE: AKA), +133%

3. BARK Inc. (NYSE: BARK), +122%

At $5.3Bn market cap at the end of last year, sexual wellness brand Hims & Hers has seen a meteoric rise in performance, with its value having nearly tripled in 2024. This is driven by growth in the brand’s fundamentals, with double digit percentage increases in both sales and adjusted EBITDA. This combined with strong subscriber growth and more optimistic full year guidance led to the stock’s strong performance. Similarly, a.k.a Brands, a brand accelerator of DTC fashion brands also saw strengthening fundamentals last year, with growth in net sales and a double digital percentage increase in adjusted EBITDA. On the strategic front, the company also expanded its omnichannel initiatives, with portfolio brands like Princess Poly and Petal & Pup seeing increased presence in retail stores. BARK, the omnichannel dog brand, saw a significant increase in adjusted EBITDA without a material change in net sales. It also achieved a number of strategic wins, including securing commitments from Target and PetSmart to carry its new line of treats in 2,400 doors across the US and the successful launch of BARK Air, a new travel experience tailored for dogs.

Analysis: Is DTC “Back”?

2024 was a good year for publicly-traded CPG companies and a particularly good year for DTC brands within this group. The market cap of the DTC cohorts increased even faster than the wider S&P 500.

However, the 30% rise in market cap for the DTC cohort is not nearly enough to outweigh its decline in since 2021, resulting in an overall decline of 69% over this period. Still, it’s something. The trend is finally heading in the right direction.

The fact that DTC brands are being held to a higher valuation standard than the wider market is no surprise given the context of the past few years. If the market begins to soften this stance, then the valuations of publicly traded DTC brands will begin to rise independently of (or at least in line with) their earnings. Until then, improving profitability is the order of the day.

Or reducing losses. Warby Parker is one of the “DTC Darlings” which soared to great heights in 2021 before plummeting in 2022 and staying in the doldrums for 2023. The company’s market cap grew 75% in 2024 to $2.9Bn, on the back of increased sales and a reduction in net losses. Analysts refer to the firm’s new focus on its company-owned retail store channel as one of the key factors in its turnaround.

So while we believe it’s too early to announce that public market DTC is in any way “back”, there are certainly some positive signs from 2024. The performance of any cohort is driven by the largest companies in the cohort, and this is no exception, but taking everything into account, 2024 was by far the best year for DTC stocks since 2021. And unlike 2021, this time the improvement is based on fundamentals rather than hype.

Conclusion

2024 was a good year for publicly traded CPG and DTC companies on the North American markets. The valuations of both groups grew, with the DTC cohort growing faster than the wider S&P 500. The fact that valuation multiples fell slightly over this period is indicative of the ongoing challenging environment faced by the consumer products sector vis-à-vis investor sentiment. But there were a number of outstanding success stories in this sector in 2024 and with fundamentals improving, it’s possible that investor sentiment will turn a corner in 2025. This year will bring new challenges (new US import tariffs being among the most important), but the overall mood is one of optimism. We shall see what 2025 brings.

Methodology & Other Notes

As we outlined in detail in a prior post, we have taken a tailored approach to identifying the right basket of companies to analyse. Instead of relying on generic and over-simplified categorisations, we have taken a bespoke approach to building and defining what truly constitutes the relevant CPG and DTC dataset. For each company, we have analysed their business models, sales channels, and brands they own and identified which of the 181 product categories they are operating in. The resulting dataset is unique and provides truly relevant comparables for consumer goods and DTC brands. For example, hotels, cruise lines, and car dealerships are excluded.

Note that the analysis measuring year-on-year change over 2024 includes only those companies that have data on both 31 December 2023 and 31 December 2024. For example, in the change in market cap analysis, we only included the 433 companies in the CPG cohort that were actively trading during the entire year in 2024.

In the product category analysis, a number of companies have been grouped as “Other”. This is either because there are very few companies operating in their specific segment (Arts & Crafts and Party Supplies categories are so small that they only contain one constituent each) or because they operate in a niche that’s outside the scope of our focus (Cannabis and Tobacco, for example).

About Hahnbeck

Hahnbeck is a leading boutique investment bank focused on the DTC & retail space. If you have an exceptional DTC & retail brand and you would like to discuss your exit plans, feel free to contact us at info@hahnbeck.com for a confidential discussion.